Advertisement

Pledging mutual funds on Groww can serve two different purposes: getting trading margin (to trade F&O or Intraday) or getting a cash loan (Loan Against Mutual Funds).

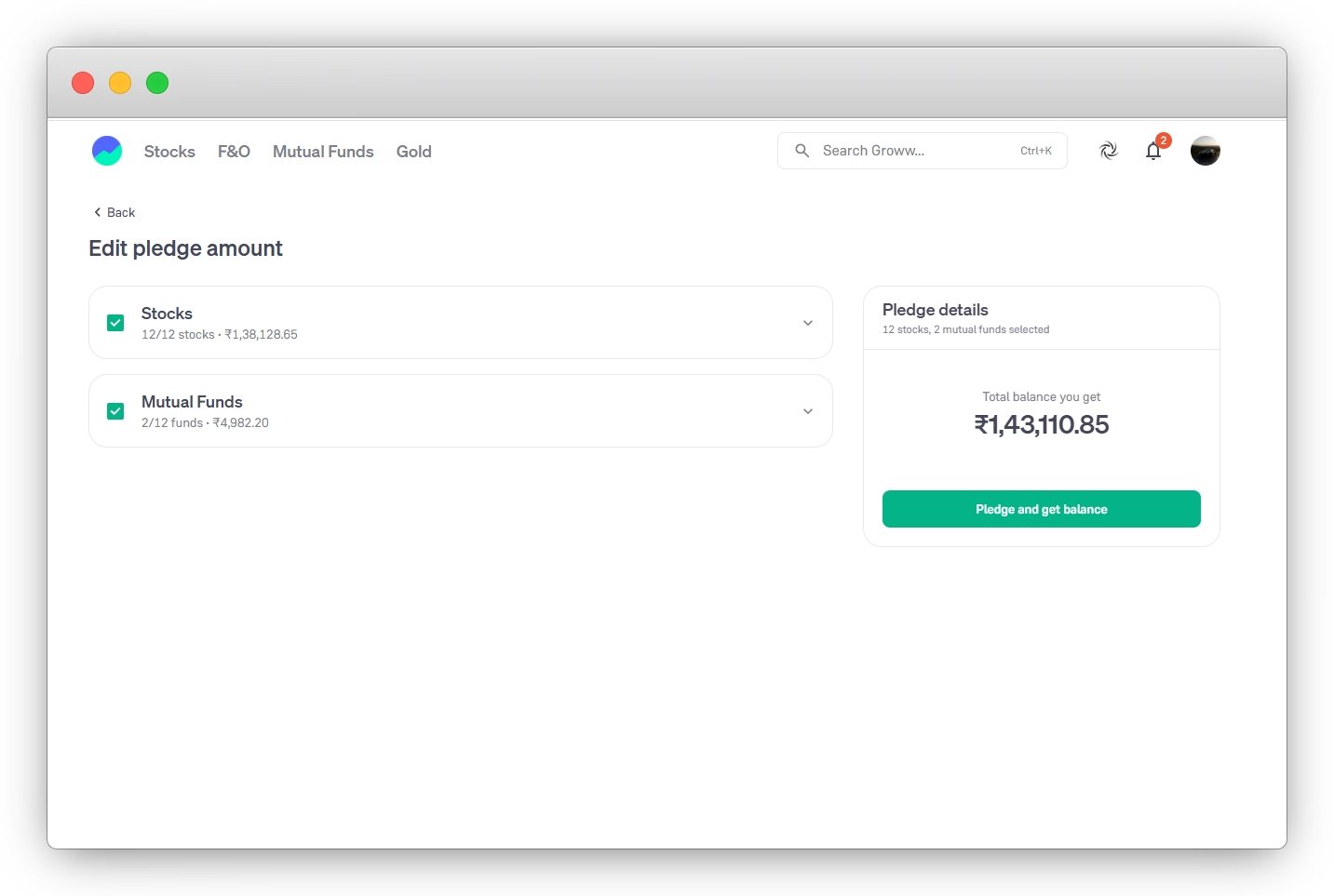

Here is the exact step-by-step breakdown for both methods.

Option 1: Pledging for Trading Margin

Best if you want to use your holdings to trade in Futures & Options (F&O) or Intraday.

- Open Groww App: Log in and tap on your Profile Icon (top right corner).

- Navigate to Balance: Tap on “Stocks & F&O Balance.”

- Access Pledge Section: Look for the option labeled “Pledge Holdings” or “Get Margin Against Stocks.”

- Select Mutual Funds: You will see a list of eligible securities. Switch to the “Mutual Funds” tab if needed.

- Enter Quantity: Select the funds and the number of units you wish to pledge. The app will display the Estimated Margin you’ll receive after the “haircut.”

- Verify via OTP: Tap on “Verify Pledge.” You will be redirected to the CDSL (depository) portal.

- CDSL Authorization: Enter your TPIN and the OTP sent to your registered mobile/email.

- Margin Activation: Once authorized, the margin is usually credited to your Groww balance within 10-15 minutes (or by the next trading day if requested after market hours).

Option 2: Pledging for a Cash Loan (LAMF)

Best if you need actual cash in your bank account for personal use.

- Go to Groww Credit: In the Groww app, look for the “Groww Credit” or “Loan” section.

- Fetch MF Holdings: The app will fetch your portfolio and show you a pre-approved Loan Offer based on your holdings.

- Select Funds & Amount: Choose which specific mutual funds to pledge and the amount of loan you need.

- Complete Video KYC: If required, finish a quick 2-minute Video KYC to verify your identity.

- Set Up Auto-Pay: Link your bank account and set up an e-mandate (Auto-pay) for easy interest repayments.

- Confirm Pledge: Just like the margin process, you will authorize the pledge via CDSL OTP.

- Withdraw Funds: Once processed, your credit line is activated. You can now transfer the money directly to your linked bank account.

Key Checkpoints Before You Start

- Eligible Funds: Only “Direct” and “Demat” held mutual funds are eligible. ELSS funds (Tax Savers) cannot be pledged during their 3-year lock-in period.

- Pledge Charges: Groww typically charges a small one-time fee of ₹20 + GST per ISIN (per fund) for pledging.

- Haircut: Remember you won’t get the full value. Equity funds usually have a ~10-20% haircut, meaning you get 80-90% of the value as margin/loan.

- Timing: Pledge requests are best placed between 6:00 AM and 9:00 PM on business days for the fastest processing.

Would you like me to find the latest “haircut” list for specific mutual funds you own to see exactly how much margin you’d get?