If you’re an investor looking to unlock additional trading margin without selling your holdings, pledging mutual funds can be a smart move. Groww makes this process simple and user-friendly, even for beginners. In this guide on how to pledge mutual funds on Groww, you’ll find a step-by-step walkthrough covering eligibility, charges, and important things to keep in mind before pledging. This approach allows you to use your existing mutual fund investments as collateral while staying invested for the long term.

Here is the exact step-by-step breakdown for both methods.

Option 1: Pledging for Trading Margin

Best if you want to use your holdings to trade in Futures & Options (F&O) or Intraday.

- Open Groww App: Log in and tap on your Profile Icon (top right corner).

- Navigate to Balance: Tap on “Stocks & F&O Balance.”

- Access Pledge Section: Look for the option labeled “Pledge Holdings” or “Get Margin Against Stocks.”

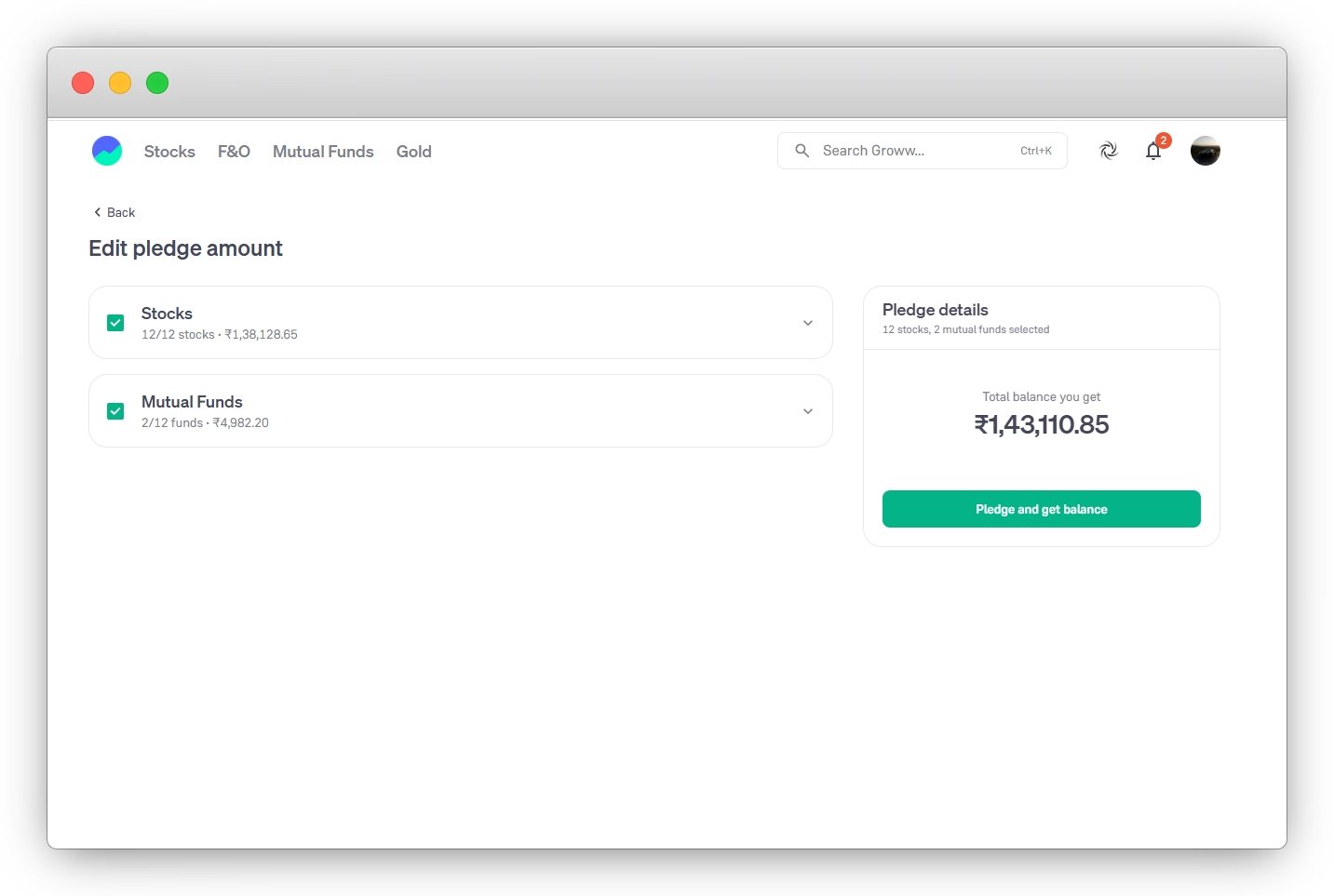

- Select Mutual Funds: You will see a list of eligible securities. Switch to the “Mutual Funds” tab if needed.

- Enter Quantity: Select the funds and the number of units you wish to pledge. The app will display the Estimated Margin you’ll receive after the “haircut.”

- Verify via OTP: Tap on “Verify Pledge.” You will be redirected to the CDSL (depository) portal.

- CDSL Authorization: Enter your TPIN and the OTP sent to your registered mobile/email.

- Margin Activation: Once authorized, the margin is usually credited to your Groww balance within 10-15 minutes (or by the next trading day if requested after market hours).

Option 2: Pledging for a Cash Loan (LAMF)

Best if you need actual cash in your bank account for personal use.

- Go to Groww Credit: In the Groww app, look for the “Groww Credit” or “Loan” section.

- Fetch MF Holdings: The app will fetch your portfolio and show you a pre-approved Loan Offer based on your holdings.

- Select Funds & Amount: Choose which specific mutual funds to pledge and the amount of loan you need.

- Complete Video KYC: If required, finish a quick 2-minute Video KYC to verify your identity.

- Set Up Auto-Pay: Link your bank account and set up an e-mandate (Auto-pay) for easy interest repayments.

- Confirm Pledge: Just like the margin process, you will authorize the pledge via CDSL OTP.

- Withdraw Funds: Once processed, your credit line is activated. You can now transfer the money directly to your linked bank account.

Key Checkpoints Before You Start

- Eligible Funds: Only “Direct” and “Demat” held mutual funds are eligible. ELSS funds (Tax Savers) cannot be pledged during their 3-year lock-in period.

- Pledge Charges: Groww typically charges a small one-time fee of ₹20 + GST per ISIN (per fund) for pledging.

- Haircut: Remember you won’t get the full value. Equity funds usually have a ~10-20% haircut, meaning you get 80-90% of the value as margin/loan.

- Timing: Pledge requests are best placed between 6:00 AM and 9:00 PM on business days for the fastest processing.

Would you like me to find the latest “haircut” list for specific mutual funds you own to see exactly how much margin you’d get?